Chile’s government reached an agreement with opposition lawmakers on the main sticking point in a proposal to raise taxes on copper miners in the biggest-producing nation.

Seeking a victory after a series of electoral and legislative defeats, the government agreed to amend its so-called mining royalty bill to cap the maximum effective tax rate at 46.5% of operating profit from 47% previously. It’s the latest concession as the bill passes through a finance committee before a vote on the Senate floor later this week.

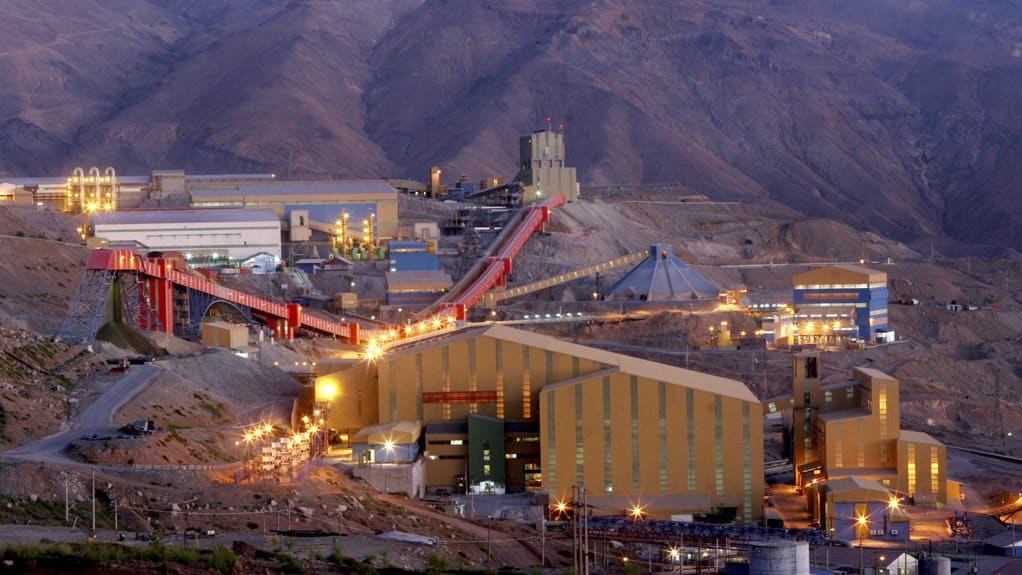

Finance Minister Mario Marcel is attempting to increase the government’s take of copper earnings to fund increased social spending, without undermining the nation’s competitiveness as an investment destination. At stake are tens of billions of dollars in projects needed to help meet growing demand for the wiring metal in the clean energy transition.

The slightly lower upper limit would bring down the average effective tax rate for large producers to about 45%, according to Juan Carlos Guajardo, who heads consulting firm Plusmining. Chile’s major competitors have a tax burden of 41% to 44%.

“Chile would not be in the best part of the competitiveness table with this,” Guajardo said. “But in the end, competitiveness is the result of other factors and if Chile sorts itself out on issues such as the political situation and permits, it will continue to be an investment destination.”

On Monday, senators in the finance committee approved a section of the bill that would introduce an ad valorem tax of 1%. The committee will continue voting article by article on Tuesday.

Over the weekend, opposition groups secured more than the three-fifths majority needed to push through articles at will in a council charged with drafting a new constitution in a blow to the government of President Gabriel Boric. That followed defeats of a previous constitutional rewrite backed by Boric and a broad tax reform proposal.