Iron-ore steadied to remain on track for its worst week since March, with few signs of a recovery for China’s beleaguered steel market.

“There is no significant improvement in demand for steel products, so there’s little room for steel mills to resume production,” Zhang Shaoda, an analyst with China Futures Co., said by email. “The downward trend for iron ore is expected to continue.”

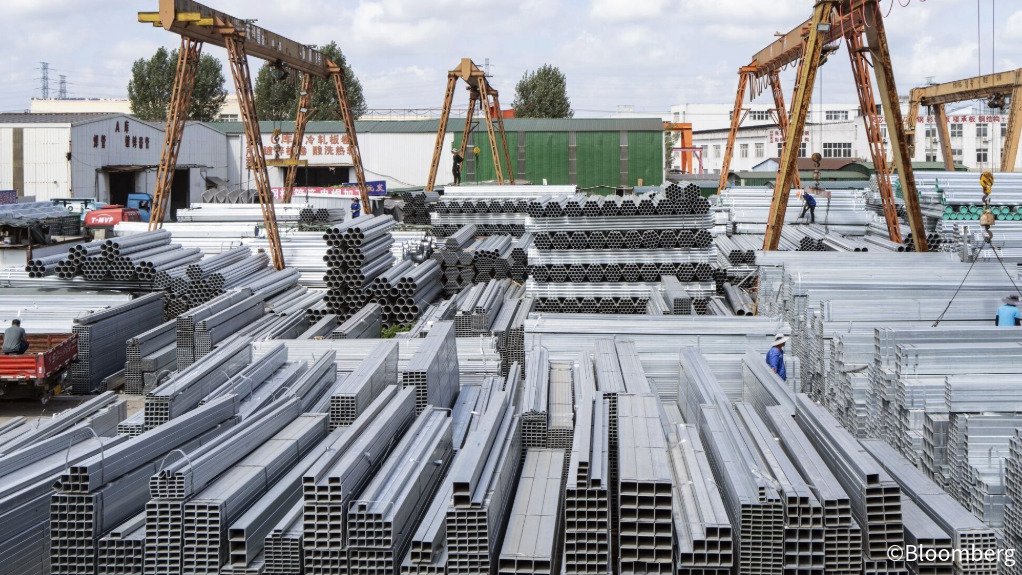

Steel consumption in China has weakened because of the country’s protracted real estate slowdown. While exports and growth in other sectors are softening the blow, cuts to steel output have left the iron ore market saddled with excess supply.

Singapore futures for iron ore were little changed at $91 a ton as at 10:10 a.m. local time, after posting the lowest close since 2022 on Thursday. They fell more than 10% over the previous five sessions.

Spot steel prices in China have continued to decline this week, underscoring weakness even as the market heads into what’s typically a busier construction period. Hot-rolled coil, which had posted a recovery in the second half of August, has returned to its cheapest since 2017, according to Shanghai SteelHome E-Commerce Ltd.