Chilean State-run miner Codelco has purchased Enami’s 10% stake in Teck’s Quebrada Blanca mine in northern Chile for $520-million, it said on Thursday.

The deal will contribute 25,000 to 30 000 metric tons of copper to Codelco’s annual output, Codelco said. The deal comes as the world’s top copper miner is struggling to boost declining production levels.

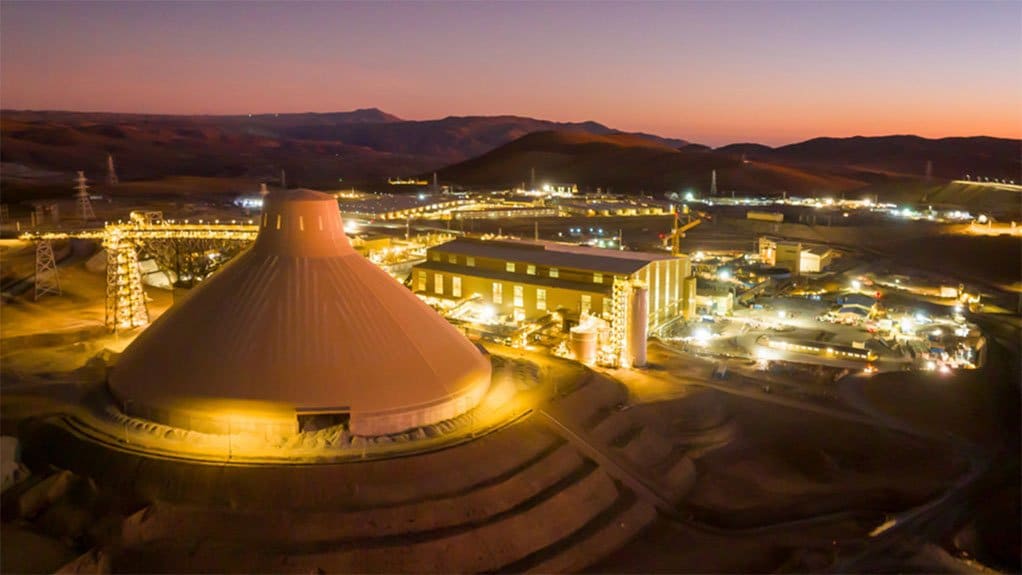

Quebrada Blanca last year inaugurated an $8-billion expansion allowing it to produce, in total, 320 000 tons of copper annually in its first five years of operation.

Codelco said it will maintain the share rights held by Enami, which is also a state-run company and processes copper for small and medium miners.

The share rights include preferential dividends, protection from dilution in future capital increases and the ability to appoint two of 11 board members.

Codelco Chairman Maximo Pacheco in a statement said the deal highlights the company’s efforts to ensure “enhanced access to large-scale assets, reduced risk and diversified opportunities.”

He said it is in line with the company’s strategy of expansion through partnerships.

Codelco has also partnered on copper projects with Anglo American, Freeport and Rio Tinto, and is set to soon enter a lithium joint venture with SQM.

Analyst Andres Gonzales of consultancy Plusmining said the boost to Codelco’s production levels from Quebrada Blanca would do little to offset declining output, and said it could weigh further on Codelco’s already heavy debt.

“This helps, but it won’t be a determining factor to compensate for the drop in production of recent years,” he said.

Codelco said half the payment to Enami has been made, and the remaining amount will be disbursed in the next four months, pending certain terms of the agreement.

Enami last year valued its stake in Quebrada Blanca at $323.8-million. In a statement about the sale to Codelco, it said the deal will help reduce Enami’s debt to $250-million from $740-million.

Teck operates the mine with a 60% stake, while Sumitomo Metal Mining Co and Sumitomo Corp together own 30%.

Chilean mining association SONAMI had opposed the deal, saying Enami should hold a public bidding to ensure a competitive process.

SONAMI head Jorge Riesco said the group will urge the government to carefully review the deal.

“There has been a total lack of transparency in this,” he said.