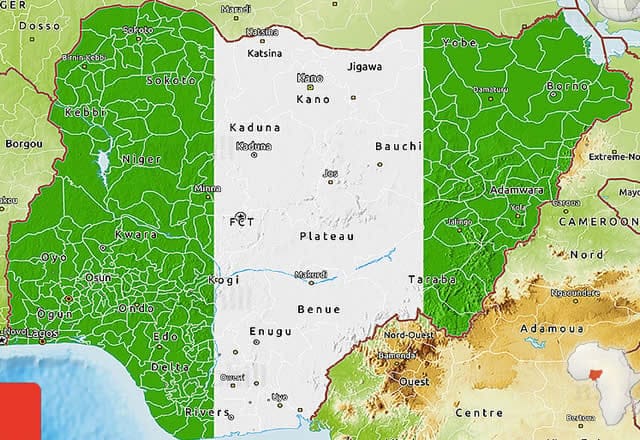

Nigeria, with its landmass of 923,768 square kilometres, is endowed with various unique geologic features, holding over 44 different minerals in over 500 locations across the 36 states of the federation and the Federal Capital Territory. In regions such as Plateau, Kaduna, Kogi, Enugu, and Nasarawa, there is a significant quantity of diverse mineral resources present, including coal, iron ore, limestone, bitumen, lead-zinc, gold, precious stones like sapphire and tourmaline, and lithium. These resources present substantial economic potential for industrialisation, development, and exportation gains. Despite this, exploitation, however, has remained low, with a series of opportunities for developing the sector remaining untapped.

Mining activities in Nigeria officially began in 1903, following the establishment of the Mineral Survey of the Northern Protectorate by the British colonial administration. This establishment introduced mechanised mining, leading to high productivity in the sector, contributing significantly to the industrialisation and development of the Nigerian economy at the time. By 1971, the Nigerian government fully took charge of the sector, reviewing its policies on mining and metals and establishing corporations that would use public funds for mining operations, for example, the Nigerian Mining Corporation. Given this, things in the sector took a different turn, with the government now directly involved and investing in the exploration of known economically viable minerals other than coal and marble.

Following the mining policy review of 1971, the Nigerian government again, in 1972, enacted an indigenisation decree that resulted in the acquisition of the majority of shares in the main expatriate tin mining companies in the country, resulting in a large-scale withdrawal of foreign investment and a downturn in production in the industry. While multinational companies and their expatriate professionals exited the country, small-scale indigenous miners took over the sector, leading to a large decline in production, and the general natural mineral sector became unstructured, especially the metallic minerals. Against this backdrop, the Nigerian government in 2016 decided to reorganise the sector by launching “A Road Map for the Growth and Development of the Nigerian Mining Industry”, with a core focus on the sector’s development.

The 2007 Nigerian Minerals and Mining Act vested ownership of all mineral deposits in the Federal Government, which allocates revenue to host states using the 13 per cent derivation formula applied in oil and gas. The Act also granted the Federal Government exclusive rights to issue exploration and exploitation licences. As the primary legislation regulating the mining sector, the NMMA was complemented by the 2009 National Minerals and Metals Policy, which aimed to promote private sector participation through transparency, compliance, and support for small-scale mining. Despite this, however, obtaining a mining licence in Nigeria remains challenging due to bureaucratic bottlenecks, institutional weaknesses, corruption, and extensive documentation requirements.

For instance, a Reconnaissance Permit may be granted to individuals, incorporated companies, or mining cooperatives to obtain and remove small quantities of samples. It excludes drilling and other subsurface activities, has a one-year duration, and is renewable annually. Although the permit is expected to be processed within 30 days, delays are common. Similarly, an Exploration Licence is issued to incorporated companies, mining cooperatives, or holders of an RP for a designated mining area. It authorises exploration, bulk sampling, testing, and limited export or sale of mineral resources, covering up to 200 sq km in a single contiguous polygonal area. The EL is valid for three years, renewable for an additional two years, with a processing period expected to be within 30 days, yet delays are inevitable.

Currently, Nigeria has no large-scale mining operations in progress, driven mainly by an unfavourable investment climate and persistent policy uncertainty. Developing a large-scale mine requires a lengthy timeframe before it becomes productive, and further delay in acquiring a license can discourage investors. In many cases, especially for major projects, preparation and construction can take three to five years before production actually begins, and even longer for more complex operations, further discouraging investors by putting them at risk of losing out. Investments like this are only possible in an environment where investors have confidence that their returns will ultimately be secured.

Although the mining industry remains loosely structured and obtaining a license is still a challenge, the sector recorded remarkable progress between 2023 and 2024. In 2024 alone, over N12.58bn was generated from licensing —a 107 per cent increase compared to 2023. This growth was largely driven by the recent government-led policy reforms, such as the creation of the Africa Minerals Strategy Group and the adoption of AMREC-PARC under the Accelerated Mining Development Programme.Related News

Several key minerals, including limestone, coal, granite, and laterite, recorded upward trends during this period. Limestone saw the most significant growth, contributing nearly 69 per cent of total mineral production by weight in 2024. This was primarily driven by the surge in cement demand, itself a response to rising construction activity and wider socioeconomic development across the country.

Precious and critical metals also performed strongly: gold, lithium, and tin recorded increases of 104.46 per cent, 252.19 per cent, and an astonishing 4,014 per cent, respectively.

Tin posted the highest leap, expanding more than 40-fold, while lithium more than tripled its contribution—both reflecting the mounting global demand for critical minerals.

The AfCFTA Investment Protocol forms part of the broader African Continental Free Trade Area agreement, which seeks to build a single continental market for goods and services. Its purpose is to encourage greater intra-African investment flows and opportunities while promoting, facilitating, retaining, protecting, and expanding investments that drive the sustainable development of member states. The protocol also aims to create a balanced, transparent, and predictable legal and institutional framework for investment that reflects the interests of governments, investors, and local communities alike. In addition, it provides a foundation for preventing, managing, and resolving investment disputes while supporting the transfer of relevant and appropriate technologies across Africa, making it suitable for fostering sustainable growth, strengthening regional value chains, and enhancing Africa’s competitiveness in the global economy.

This protocol can be an important vehicle for unlocking Nigeria’s critical mineral resource potentials by establishing a stable and transparent investment framework that attracts both domestic and foreign capital. By harmonising rules across Africa, the protocol reduces policy uncertainty, strengthens regulatory consistency, and limits the discretionary powers that often enable institutional failure and corruption in the sector. It promotes accountability through clear dispute-resolution mechanisms, encourages sustainable and responsible investment, and supports technology transfer and cross-border cooperation. With these safeguards in place, investor confidence is boosted, enabling Nigeria to better harness resources such as lithium, gold, and tin. Ultimately, the protocol positions Nigeria’s solid minerals sector to drive industrialisation, create regional value chain linkages, and support long-term economic growth.