For more than a decade, the U.S. coal industry has been in decline — with waning investment, shrinking capacity, and the steady rise of gas and renewables. Yet, in 2025, a different story is emerging. Across the country, coal units once scheduled for quiet retirement are being called back into service in ways few anticipated—driven not by nostalgia, but by a new kind of demand shock: the rise of artificial intelligence (AI), data centers, and industrial reshoring.

Massive, round-the-clock power needs from AI and cloud computing, along with “Made in America” manufacturing growth, have led to a capacity crunch that renewables and gas alone can’t satisfy. Momentarily eased policy pressures have allowed coal plants a second act—one defined not by expansion, but on efficiency, reliability, and return on investment.

From Survival to Selective Modernization

Over the past decade, most coal plants operated in “maintenance-only mode.” With low wholesale prices and high regulatory uncertainty, investment was deferred, units slipped to lower efficiency levels, and chronic slagging and fouling became routine.

Now, utilities are being asked to do more, operate more efficiently, and run cleaner without significant capital upgrades. This has pushed operators to focus on selective modernization, especially in areas that provide immediate, measurable benefits.

Reclaiming Lost Megawatts Through Chemistry

One of the most effective tools transforming coal economics is fuel chemistry optimization—led by Environmental Energy Services (EES) and its CoalTreat additive program. CoalTreat additives are applied to the fuel and can alter coal ash characteristics during and after combustion, raising fusion temperatures, decreasing fouling, and recovering lost megawatts.

In one 750-MW tangential-fired boiler, CoalTreat eliminated reheat-section slagging that had previously caused derates. The unit increased output by 3% and lowered NOx emissions by 0.02 lb/MMBtu.

Another 650-MW plant firing high-slag Illinois Basin and Northern Appalachian blends operated five consecutive days at full load—a feat once impossible—after treatment. Infrared boiler cameras confirmed clean pendant and nose-arch surfaces throughout the run.

The economic benefits are equally significant. Switching from premium Central Appalachian to Illinois Basin fuel saved plants $40 per ton while keeping output and compliance intact. At another location, slagging had lowered furnace exit-gas temperatures by 100F, which improved heat rate by 2.5% and increased net annual revenue by an estimated $2.5 million.

Inside the Process: How Additives Transform Ash

Slag formation begins when minerals in coal, such as silicates, iron, sodium, and potassium, are volatilized and/or react during combustion to create high-strength, low-melting point, sometimes glassy deposits that adhere to tube surfaces.

CoalTreat works by introducing specially formulated chemical additives that alter ash chemistry, promoting the formation of brittle crystals (high-melting crystalline structures like anorthite and hematite) instead of “sticky” amorphous glass. The result:

- Fluxing or molten deposits become solid and friable, and are easily removed by sootblowing.

- Ash fusion temperatures increase by 150F to 200F.

- Accumulated slag or fouling is weaker, as shown in sintering strength data, becoming increasingly friable and more easily removed by existing equipment.

- Forced outages and heat transfer losses decrease.

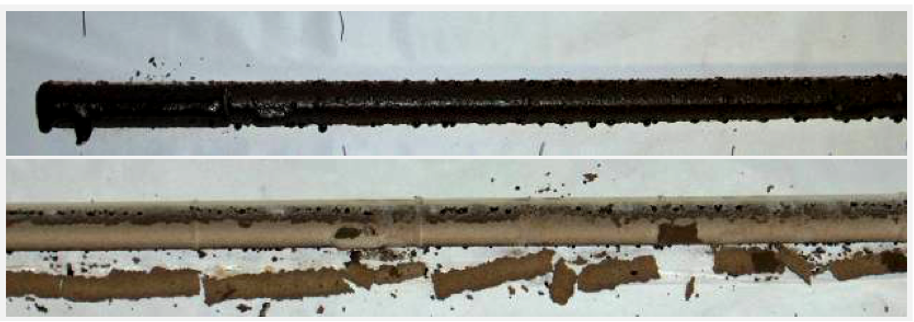

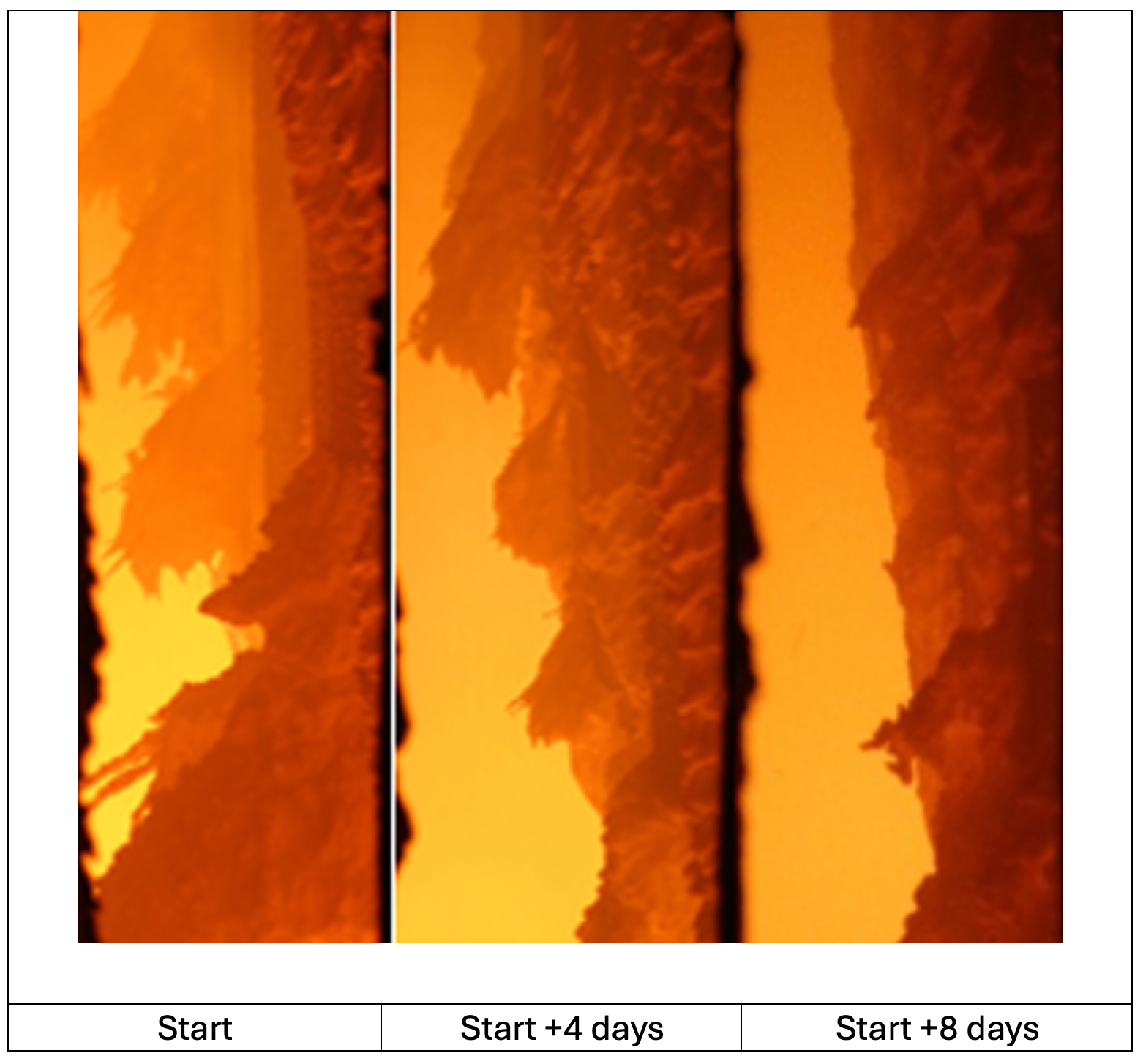

Changes in ash chemistry can be observed through high-temperature probe (HTP) testing that simulates tube-surface conditions (Figure 1). Probe accumulations and associated temperature mapping data consistently show reduced slag adhesion and no or reduced “black glass” formation, validating the chemistry’s effectiveness in actual furnace operating conditions (Figure 2). HTP testing, along with furnace infrared photography/thermography conducted during field trials can be used to verify performance in short demonstration programs.

Field Proven: Restoring Lost Megawatts Through Fuel Chemistry

The shift from maintaining the status quo to a renewed focus on maximizing generating capacity and reliability is borne out daily across the U.S. fleet. Utilities that once viewed additive chemistry as a tool of last resort are now actualizing significant operational and financial returns. The following case study from a U.S. coal-fired generating unit demonstrates how a targeted CoalTreat program restored lost megawatts, improved heat rate, and delivered multimillion-dollar gains—all without capital upgrades.

Case Study: Restoring Lost Capacity Through Chemistry

A Midwestern public utility operates a 500-MW-class generating unit burning a high-moisture, moderate-ash coal blend. The unit had faced persistent derates and forced outages due to severe slagging. Traditional sootblowing, load-shedding, and best practices proved inadequate, resulting in the loss of thousands of megawatt-hours of generation annually—often during high-value peak periods.

Implementing a custom additive treatment increased ash fusion temperatures by approximately 200F and through crystal changes in the slag reduced adhesion and accumulation. During the initial test period, the plant avoided more than 9,000 MWh of derate due to fouling and cut forced outages by about 120 hours. Additionally, the unit improved its average heat rate by nearly 200 Btu/kWh and significantly lowered boiler maintenance and sootblower steam consumption.

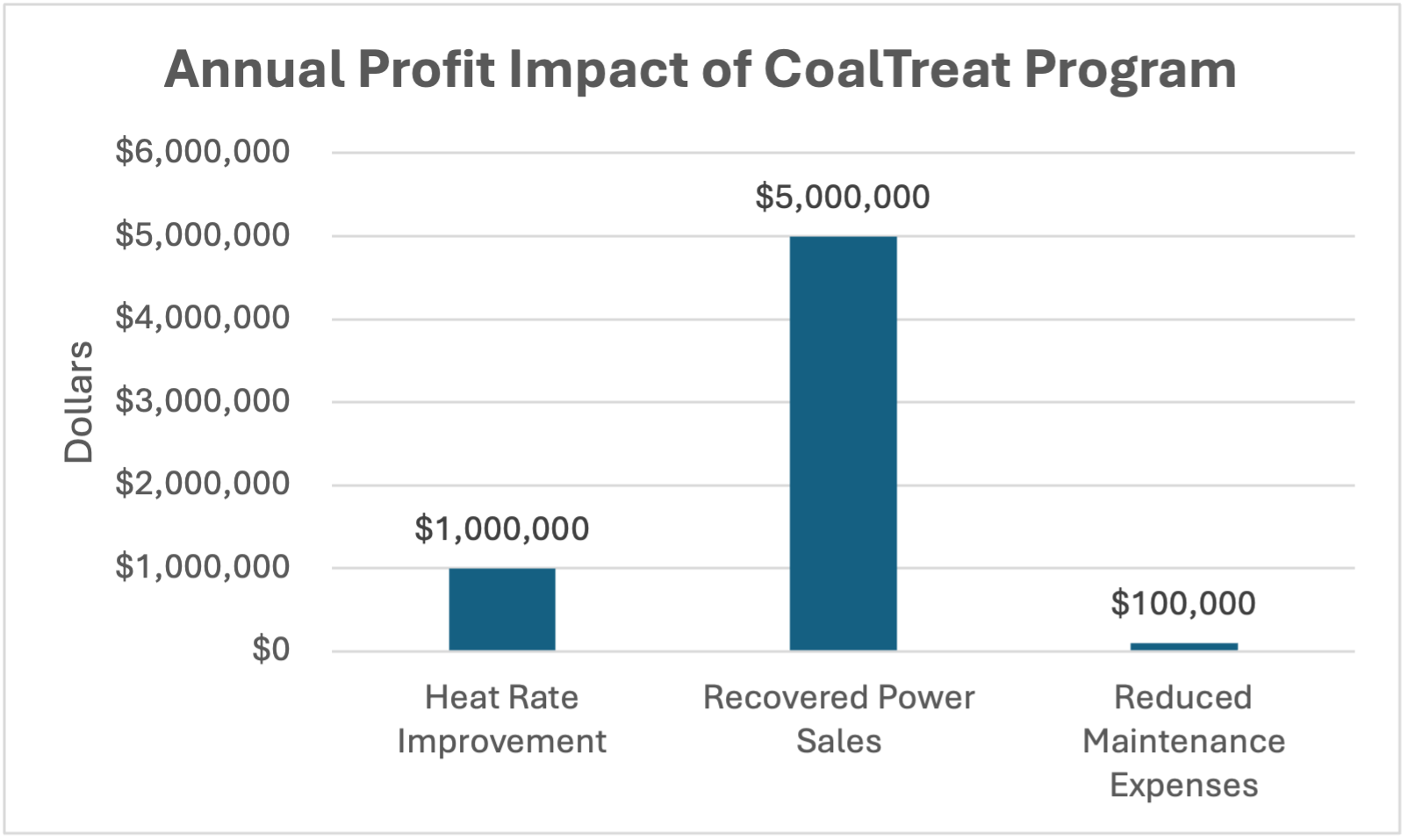

The savings from heat-rate improvement contribute approximately $1.0 million annually to the plant’s bottom line. Recovered power sales generated a net income of about $5 million per year (after fuel costs), based on an average power sale price of $100/MWh. Maintenance savings from reduced boiler cleaning and weld repairs eliminated roughly $100,000 in annual maintenance expenses.

Peak power sales in many regions will continue to rise. For example, PJM peak power prices hit $898/MWh on April 8, 2025, and $1,334/MWh on June 23, 2025. Plants that can increase power sales during peak hours can substantially boost their profitability. For example, at PJM’s June 2025 peak ($1,334/MWh), recovered MWh could yield greater than $5 million in a single event.

The primary benefit wasn’t just financial. By stabilizing combustion and extending tube life, the additive program also lowered safety risks related to explosive cleaning. Moreover, CoalTreat does not require installing water cannons or other costly maintenance additions. CoalTreat has demonstrated increased plant reliability and that chemistry-based performance recovery can replace substantial capital investments and prevent power sales losses during long upgrade outages.

Fuel Flexibility: The Competitive Edge

With tailored fuel treatment programs, utilities can confidently burn lower-cost, higher-slagging coals without sacrificing performance. This capability to switch between fuel sources offers a valuable hedge against volatile supply and pricing while providing a strategic advantage as dispatch needs evolve with AI-driven baseload growth. By enabling the use of lower-cost “opportunity” coals without sacrificing performance, plants can realize a significant increase in gross profit and maintain operational flexibility in a shifting energy landscape.

EES’s latest CoalTreat On-Demand Systems (ODS) are portable, intelligent treatment systems available for rapid deployment. Reagent dosages and blends are tailored to varying coal types and are capable of automatic control. ODS systems can be used for continuous applications to control persistent slagging or intermittent applications where particular coal blends/seams or operating conditions cause periodic issues.

As AI and reshoring drive unprecedented electricity demand (the U.S. Energy Information Administration predicts 20 GW to 30 GW of new data center load by 2030—equivalent to more than 50 coal units at 80% capacity factor), the existing coal fleet remains essential for system stability. For utility stakeholders, the message is practical: Invest selectively, measure diligently, and optimize the assets you already have. Every avoided derate, every efficiency improvement, and every ton of fuel flexibility counts in this high-demand environment (Figure 3).

In the age of AI and “big data,” coal isn’t finished yet. By embracing targeted innovation and smarter fuel chemistry, operators demonstrate that legacy assets can adapt (Figure 4), delivering cleaner, more reliable, and cost-effective power when the grid needs it most.