Evolution Mining reported a rise in its second-quarter gold production on Wednesday, driven by strong performances across almost all assets, sending its shares to a record high.

Shares of the company, majority owned by AustralianSuper – the country’s largest pension fund, rose as much as 9.18% to a record A$14.750, posting their biggest intraday percentage gain since August 14, 2024.

The gold miner produced 191 000 oz of gold in the final quarter of last year, compared with 174 000 oz in the previous quarter.

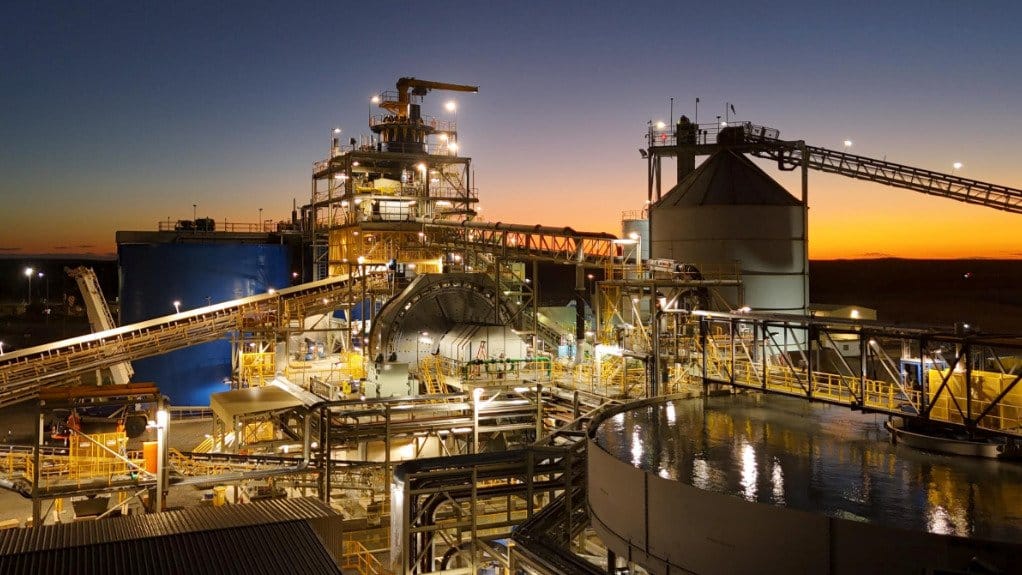

Evolution attributed the output rise to strong operational performance at its Cowal project in New South Wales. The open-pit mine produced 80 000 oz of gold in the December quarter, compared with 71 000 oz in the previous quarter.

Underground operations at Cowal remained smooth as the mine delivered higher-quality gold. Evolution is the sole owner of the mine, which has a mine life until 2042.

Analysts at Jefferies said Cowal’s production was broadly in line with Visible Alpha estimates.

The underground mining hub of Mungari in Western Australia logged record quarterly output of 50 000 oz in its fourth straight quarter of production growth.

The group achieved a quarterly gold price of A$6 206 per ounce, higher than the previous quarter, due to a historic rally in global bullion prices.

“While in line with consensus, 2Q gold production exceeded our expectations,” Jefferies said in a note, adding that record gold prices boosted Evolution’s balance sheet.

Sydney-headquartered Evolution reaffirmed its fiscal 2026 group production forecast of 710 000 oz to 780 000 oz for gold and 70 000 to 80 000 metric tons for copper.

The company produced 18 000 tons of copper in the December quarter, unchanged from the previous three-month period.