The announcement this week that US-based Energy Fuels has made a move for Australian Strategic Materials has underlined the continued momentum building across Australia’s rare earths sector.

That momentum has only accelerated since last year’s US–Australia Critical Minerals Framework was unveiled, alongside further clarity from the Federal Government on the structure of its Critical Minerals Strategic Reserve, with rare earths placed firmly at the centre of the strategy.

Against that backdrop, here are five significant rare earth element (REE) projects currently in development or construction in Australia to watch as the sector gathers pace into 2026.

Lynas Rare Earths

Lynas Rare Earths occupies a unique and strategically important position in Australia’s critical minerals landscape as the largest producer of rare earth elements outside China.

Headquartered in Perth, Lynas operates the world-class Mt Weld rare earths mine in Western Australia, one of the highest-grade deposits globally. In a major step toward onshore value-adding, the company has established Australia’s first rare earths cracking and leaching facility at Kalgoorlie, enabling early-stage processing to occur domestically before further separation offshore.

Over the past year, Lynas has continued to strengthen its role in global supply chains, advancing heavy rare earth production and supporting the diversification of magnet materials critical to defence, renewable energy and electric vehicle technologies. The company has also progressed downstream expansion initiatives in Malaysia and the United States, reinforcing its position as a trusted supplier to Western allies.

Despite operational challenges, including infrastructure disruptions at Kalgoorlie, Lynas remains focused on meeting customer demand while expanding capacity. Long-time chief executive officer Amanda Lacaze has also announced plans to retire in 2026, marking the end of a defining chapter for the company.

Iluka Resources – Eneabba Rare Earths Refinery

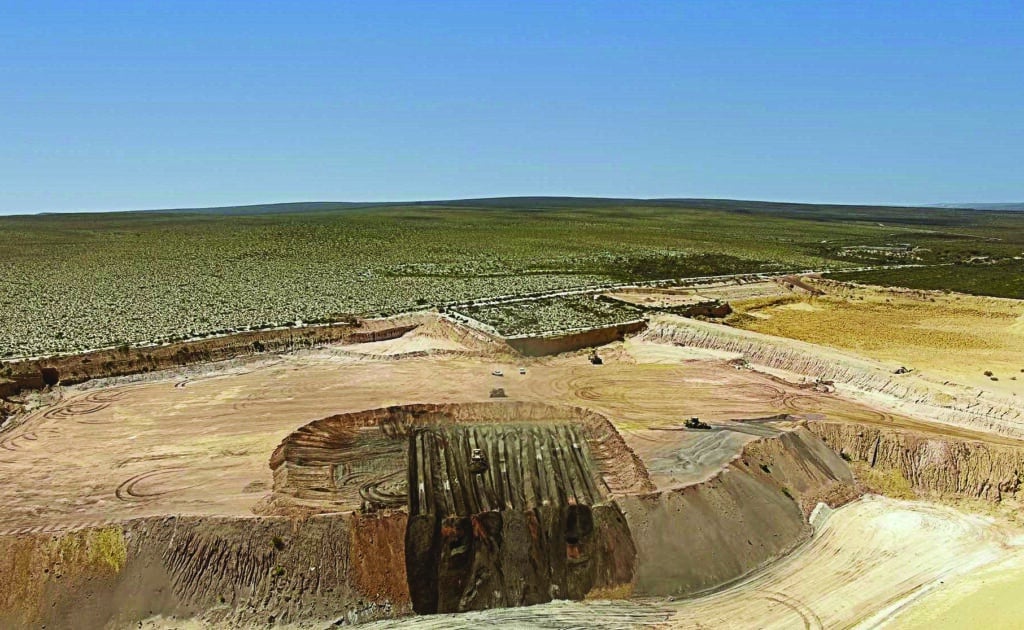

Perth-headquartered Iluka Resources has long been a heavyweight in global mineral sands production, but is now pivoting decisively toward the critical minerals era with construction of Australia’s first fully integrated rare earths refinery at Eneabba in Western Australia.

Traditionally known for zircon, rutile, ilmenite and synthetic rutile, Iluka has been stockpiling rare-earth-bearing monazite and xenotime from its operations for more than three decades, recognising their growing strategic value as demand for clean-tech materials accelerates.

Backed by the Federal Government’s Critical Minerals Facility, the Eneabba Rare Earths Refinery is under construction, with commissioning scheduled for 2027. The facility is expected to produce separated light and heavy rare earth oxides including neodymium, praseodymium, dysprosium and terbium — essential inputs for electric vehicles, wind turbines and defence technologies.

Iluka’s strategy positions Eneabba as a downstream processing hub capable of accepting third-party feedstock, diversifying supply chains beyond China’s dominance and strengthening Australia’s sovereign rare earths capability.

Arafura Rare Earths – Nolans project

Arafura Rare Earths is advancing one of Australia’s most strategically important rare earths developments with its Nolans project in the Northern Territory.

Located about 135 kilometres north of Alice Springs, Nolans is fully permitted and construction-ready, targeting a vertically integrated mine-to-separation operation producing high-purity neodymium-praseodymium (NdPr) oxides for permanent magnets used in EVs, wind turbines and defence technologies.

Over the past 18 months, Arafura has secured major financing milestones, including a $200 million binding term sheet with the National Reconstruction Fund Corporation, alongside ongoing engagement with Export Finance Australia.

Binding offtake agreements for NdPr oxide have also been secured, strengthening the project’s commercial foundations ahead of a final investment decision.

Hastings Technology Metals – Yangibana project

Emerging ASX-listed developer Hastings Technology Metals is advancing the Yangibana rare earths and niobium project in Western Australia’s Gascoyne region.

Yangibana is positioned to become a globally significant source of NdPr, with one of the highest NdPr ratios of any known rare earths deposit. The project now operates under a 60:40 unincorporated joint venture with Wyloo Metals, which has been appointed operator to accelerate development toward first production targeted in 2026.

Early works are well underway, with access infrastructure and camps established and all major approvals in place.

Australian Strategic Materials

Australian Strategic Materials (ASM) has emerged as a key player in Australia’s ambition to build a rare earths supply chain that extends beyond mining to processing and metals production.

At the centre of ASM’s strategy is the Dubbo project in central western New South Wales, a polymetallic resource hosting light and heavy rare earths alongside zirconium, niobium and hafnium. Unlike many peers, ASM has pursued a “mine-to-metals” strategy, already operating a Korean Metals Plant producing NdPr and other rare earth products, with commercial sales of heavy rare earth metals underway.

The proposed acquisition by Energy Fuels marks a significant step towards creating a fully integrated rare earths champion outside China, reinforcing Australia’s role in global critical minerals supply chains.