In line with a government program, Germany will shutter its coal-powered plants to drastically reduce CO2 emissions. But until this coal exit is completed in 2038, Europe’s powerhouse will need more imports.

Energy generation in Germany by burning lignite and hard coal has decreased significantly in the past couple of years. The government’s resolve to exit coal as an energy source by 2038 as part of a larger climate protection program is bound to accelerate this trend.

The country is also phasing out nuclear energy, meaning that renewables — wind and solar in particular — will have to assume an ever increasing role in providing the nation with the energy it needs to keep playing in the top league of industrialized nations.

But a complete coal exit is almost two decades away. Right now, coal-based energy generation in Germany still accounts for roughly a quarter of the total energy produced.

What’s relevant in this context is that hard coal mining has already been stopped in the country. The last mine at Bottrop in western Germany closed as early as December 2018.

The same fate is eventually awaiting the coal-fired power plants. Under the current coal exit scheme, all remaining coal-powered stations will shut down by 2038.

The controversial opening in May of a new such power plant, Datteln 4, in the German state of North Rhine-Westphalia, is viewed as a bad joke by environmentalists, but will not change the overall strategy that envisages eventually cutting the nation’s CO2 emissions by a quarter within the next 18 years (Germany aims to cut all greenhouse gas emissions to 55% of its 1990 levels by 2030).

With all hard coal mines closed, where does Germany get its coal from then?

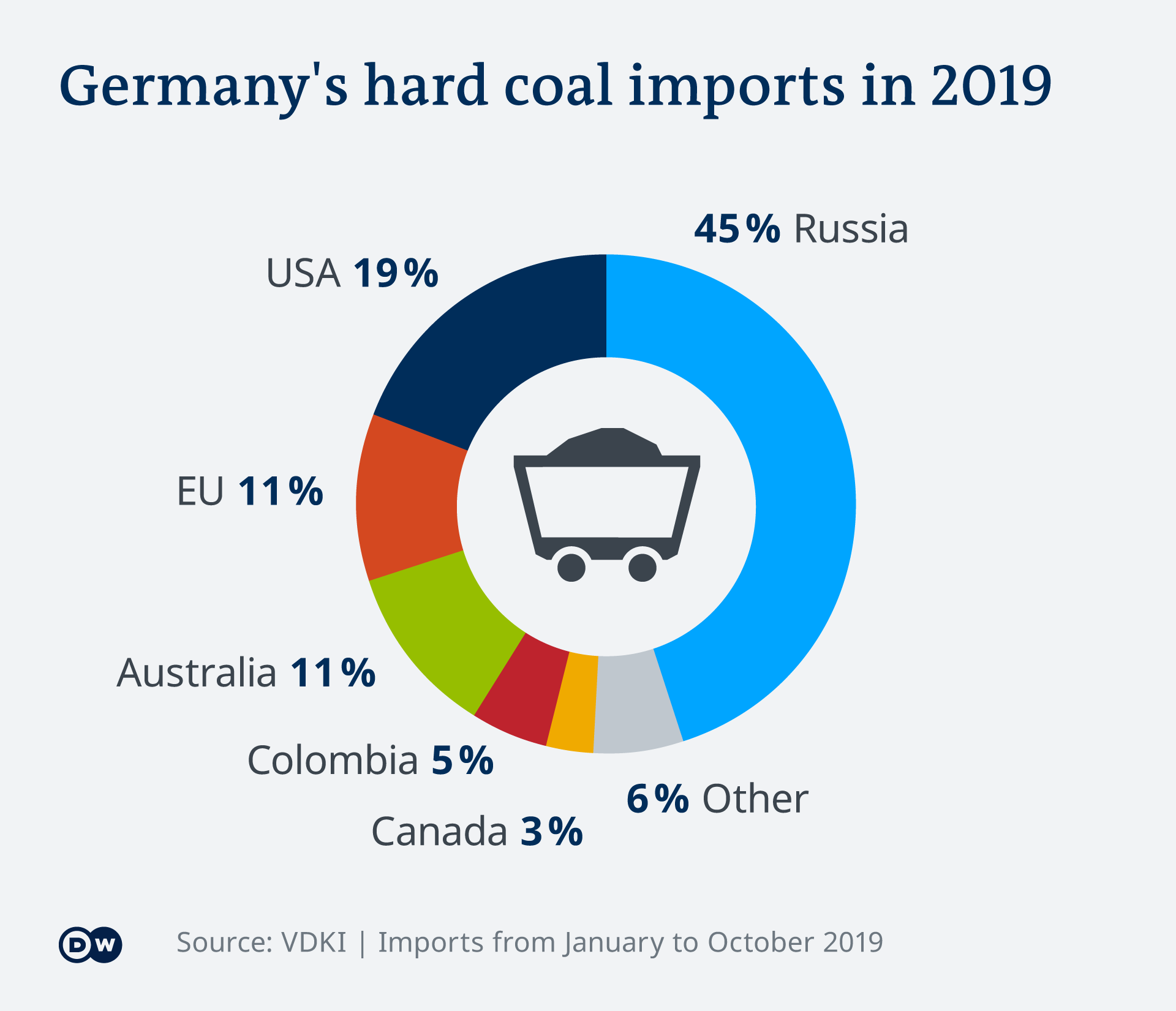

The German Coal Importers Association (VDKi) provides some interesting insights. While there’s been a lot of debates about Germany (and the rest of the EU) being too dependent on Russian gas supplies, you hardly hear anything about Russia having been Germany’s main supplier of hard coal for years on end.

Last year, Germany’s hard coal imports from Russia (including steam and coking coal) made up 45% of all shipments from abroad. Another 19% came from the US, with fellow EU nations combined and Australia sharing third position at 11% each. All in all, Germany imported 40.2 million tons of hard coal in 2019, down from 47.1 million tons a year earlier.

As long as these coal imports exist, Germany will only be relocating some of its environmental footprint abroad. Of all the nations where Germany gets hard coal from, two countries seem particularly problematic — Russia and Colombia. Reports by the media and environmental pressure groups suggest that safety, environmental and social standards in the mines there leave much to be desired.

Mining companies in Russia are often targeted by the country’s Ecodefense campaigners and others, who claim that the firms in question are hardly ever held accountable for any environmental damage and do not have to pay any fines.

In Colombia, there have been reports about forceful relocations of locals to make way for coal mines without being offered adequate compensation.

That hasn’t kept Germany from importing coal from these countries. The rationale behind this is the far lower price per ton for imports from nations where mining is a lot easier and cost-efficient than it used to be in western Germany’s hard coal areas. This means that even coal from faraway Australia is a bargain for Germany despite the extremely long transport routes and the resulting shipping costs involved.

Will Germany’s coal imports be in free fall as of now?

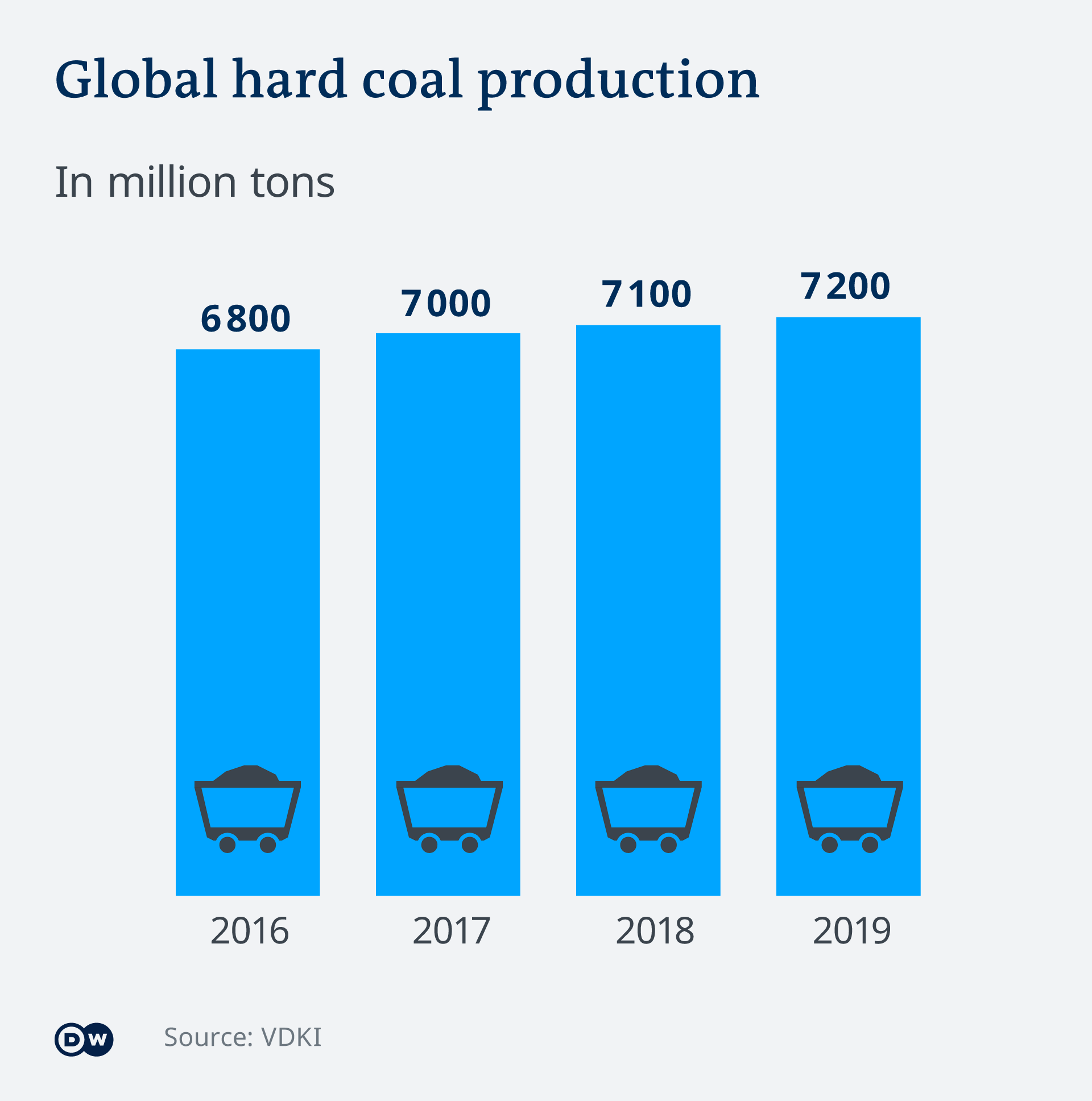

According to VDKi statistics, hard coal imports dropped by around 15% already in 2019 year on year, equaling a reduction of 7 million tons. In the same period, imports of coking coal went down by 7% and imports of steam coal by 17%. That’s a remarkable dip if seen against the backdrop of a renewed uptick in global trade in hard coal in 2019 (+0.7%) and a 2% increase in global hard coal production in the same year (7.2 billion tons).

It’s important to note that electricity generation from hard coal in Germany decreased by a staggering 31% during the period under review. Even more indicative of the road ahead is the 50% drop in energy generation from hard coal within just three years.

The reason behind this is not just the surge of power generation from renewable sources. Coal has also been losing a battle with the more cost-efficient natural gas and been facing a disadvantage as the CO2 price has increased under the EU’s emissions certificate trading scheme.

While the role of hard coal (and lignite for that matter) in energy generation for households will become smaller and smaller by the year and already is almost irrelevant for heating, it will keep its importance for the iron- and steel-producing sectors for a longer time. But eventually, these industries will have to switch to something greener, too.

The German government has just rallied behind a multibillion-euro program by Economy Minister Peter Altmaier to let those sectors become green-hydrogen-powered industries before the coal exit is completed.