South Korea, Japan, and China, countries that rely heavily on coal power generation to fuel their economies, separately announced ambitious goals to achieve net-zero greenhouse gas (GHG) emissions within the next three or four decades. While the measures were largely hailed as big wins for climate action, some industry observers noted the countries had not laid out specific paths to achieve their targets though they are certain to have major implications for the power sector.

China Poised for a Power Upheaval. China’s President Xi Jinping on Sept. 22 told the United Nations General Assembly that his country would strive to be carbon-neutral by 2060, a statement that “potentially represents the biggest climate undertaking ever made by any country,” as International Energy Agency (IEA) Chief Economist Laszlo Varro and Senior Advisor An Fengguan wrote in an October commentary.

China, which is leading the world in nuclear additions, had installed 49 GW of nuclear capacity by 2019, but nuclear power’s share of generation made up a paltry 5%. According to the IEA, in 2019, China produced 65% of its total power (7,518 TWh) from coal, followed by renewables at 27%—mostly hydropower (17%), with wind (5%) and solar PV (3%) well behind. However, only about 53% of its total 1,991 GW installed capacity was coal-fired, while 40% was renewables.

The IEA officials suggested that to meet its climate goals, clean power generation sources would “need to scale up considerably faster,” and China would have to make “strategic decisions” on its massive coal fleet. “Last but not least, part of the coal fleet can be turned into a low-carbon backbone by being retrofitted with carbon capture technologies,” they suggested.

Japan Eyes Phasing Out Inefficient Coal. Japan, an island nation that is currently heavily reliant on coal and gas power, will be carbon-neutral in 2050, the country’s newly appointed Prime Minister Yoshihide Suga pledged in an Oct. 26 speech to the national Diet. But according to the Ministry of Economy, Trade, and Industry (METI), in fiscal year 2018 (which ended in March 2019), fossil fuels accounted for 77% of the nation’s power generation, renewables totaled 17%, and nuclear power made up 6%. Suga suggested Japan will seek a fundamental revision on its policy on coal plants. It will also work to introduce renewable energy “to the maximum extent,” and “advance nuclear energy policies with a high priority on safety.” However, the country’s net-zero strategy remains murky. More details may emerge as the government seeks to review its 2018 Basic Energy Plan before the United Nations Climate Change Conference (COP 26) takes place in Glasgow, UK, in November 2021.

South Korea Pushing for a ‘Green New Deal.’ On Oct. 28, South Korea’s President Moon Jae-in also announced a net-zero target, committing to “go toward carbon neutral by 2050” in a speech to the national assembly. Moon highlighted replacing coal power with renewables, a measure that will be backed by the government’s May 2020-proposed “New Deal.”

|

|

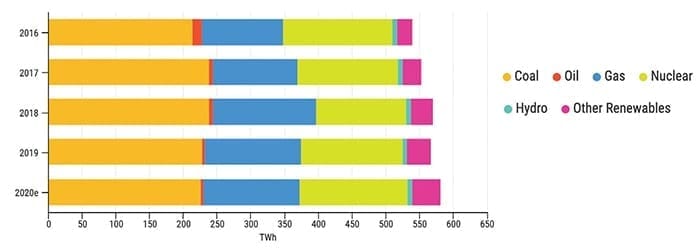

3. South Korea’s electricity generation profile by fuel, 2016 to 2020 (estimated). Source: Korea Energy Demand Outlook January 2020/Korea Energy Economics Institute/POWER |

The nation’s most recent draft electricity plan, also unveiled in May, and which covers the next 15 years, calls for renewables’ share in the overall power capacity mix to exceed 40% by 2034, while the share of liquefied natural gas (LNG) power could be reduced slightly to 31%. Coal’s share will fall—to about 15%—as will nuclear’s share, to about 17%. In 2019, the nation’s 60 coal-fired power plants generated about 40% of South Korea’s power, followed by nuclear at 26% (from 24 reactors), LNG power (25%), and renewables at 7.2% (Figure 3).

Like Japan, South Korea is largely expected to provide more details on how it will achieve its goals as COP 26 approaches. In his speech, Moon, who was re-elected in a landslide earlier this year, indicated the country will invest 8 trillion won ($7.1 billion) in projects that support establishing charging stations for electric and hydrogen vehicles. Hydrogen is also expected to play a larger role in power generation via fuel cells. In November 2019, South Korea announced a larger plan to transform 10% of its cities, counties, and towns to hydrogen power—via fuel cells—by 2030, and 30% of them to hydrogen by 2040.

At least one major state-owned utility, Korea Electric Power Corp. (KEPCO), has so far taken notable strides toward a low-carbon future. In late October, citing sustainability goals, KEPCO said it would convert its domestic coal-fired power plants to LNG and divest from or convert planned coal projects overseas.

So far, casualties of its new policy include the 630-MW Thabametsi power plant in South Africa’s Limpopo province, which had been slated to come online in 2021. KEPCO held a 50% stake in the $2.1 billion project with Japanese firm Marubeni Corp., but as of Nov. 12, both companies, along with key financiers, South Africa’s biggest state pension fund manager the Public Investment Corp. (PIC), and the Industrial Development Corp. (IDC), had withdrawn from the project. KEPCO’s policy also puts the 1-GW Sual 2 plant in the Philippines in limbo. KEPCO, however, plans to complete the $3.2 billion 1-GW Jawa 9 and 1-GW Jawa 10 coal-fired power units in Indonesia, which South Korean entities are financing. It will also complete the 1.2-GW Vung Ang 2 coal-fired power plant in Vietnam. KEPCO is building that project with several Japanese firms, but they are also under increasing pressure to divest from coal projects.