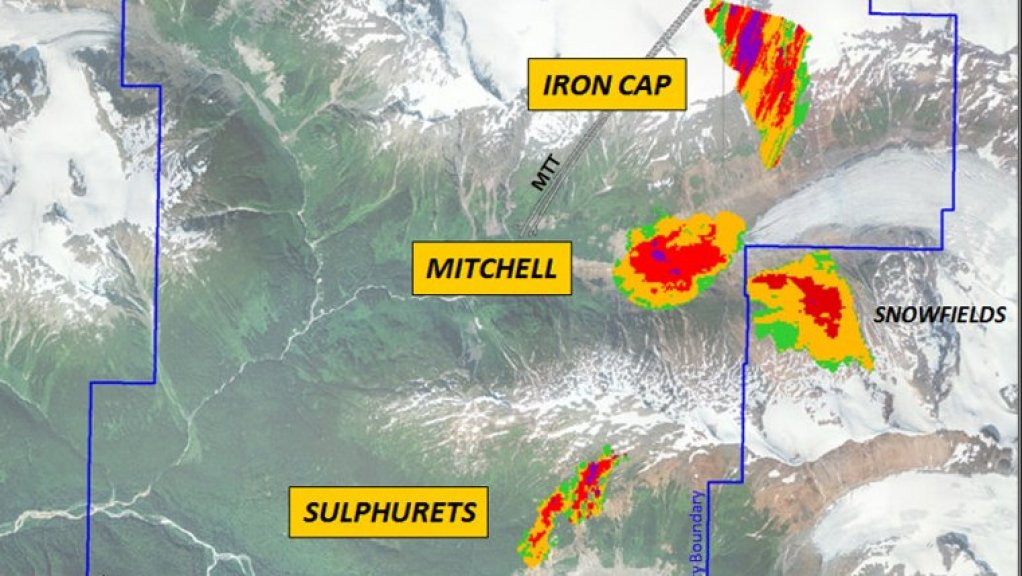

Pretium Resources (Pretivm) has agreed to sell its Snowfield property, in north-west British Columbia, to KSM Mining – a subsidiary of Seabridge Gold.

Snowfield is located in the same valley that hosts KSM’s Mitchell deposit.

Seabridge chairperson and CEO Rudi Fronk said the acquisition had a number of major benefits for Seabridge.

“First, it adds appreciably to our ounces of gold per share, our most important measure of shareholder value, at a cost of approximately $3/oz. Second, Snowfield’s measured and indicated mineral resources have the potential to significantly increase KSM’s proven and probable reserves. Snowfield’s mineral resource is 25.9-million ounces of gold in the measured and indicated category and a further 9.0-million ounces in the inferred category, as well as substantial copper resources. The estimated strip ratio for the Snowfield deposit is less than one-to-one and previous studies indicate its resources can be successfully blended with Mitchell ore.”

Work is under way to determine how to integrate Snowfield into a new KSM mine plan.“We expect a large portion of the Snowfield mineral resource could be exploited in a combined operation, which could potentially improve KSM’s IRR [internal rate of return] and NPV [net present value] projections, as well as shortening the payback period of initial capital,” Fronk said.

Seabridge’s next step is to generate additional data for a new prefeasibility study (PFS) on the KSM project to include the Snowfield property.

“We believe this new PFS will increase project reserves and improve capital efficiency by extending the life of openpit mining, thereby allowing us to delay the capital-intensive development of underground mining later in the project life,” said Fronk.

Meanwhile, Pretivm CEO Jacques Perron said the transaction provided the company the opportunity to immediately realise the value of Snowfield – an undeveloped asset that Pretivm believes is not reflected in its share price.

“The cash proceeds will significantly strengthen our balance sheet and allow us to reduce our debt while the royalty will provide long-term participation in the progress of Snowfield.”

Under the terms of the agreement, Pretivm will receive consideration comprised of $100-million in cash payable upon closing of the transaction and a 1.5% net smelter royalty (NSR) in respect to all production from Snowfield.

Pretivm is also due to receive a $20-million contingent cash payment (deferred payment), payable within six months of the earlier of KSM Mining (or a parent company) completing a bankable feasibility study, which includes reserves from Snowfield, or the commencement of commercial production from Snowfield. $15-million of the deferred payment represents an advance NSR payment and will offset amounts payable under the NSR.

The cash proceeds of the transaction will be applied to the revolving portion of Pretivm’s credit facility, which as of September 30, had an outstanding principal balance of $198-million.

The transaction is expected to close in the fourth quarter of the year and is subject to completion of a financing by Seabridge and customary closing conditions.

The transaction will result in a non-cash impairment loss to be recorded in the fourth quarter of 2020.

As of September 30, the book value of Snowfield was $232.1-million.