The exchange, the world’s oldest and largest market for industrial metals, launched a discussion paper on the subject in October and then said on November 11 it had decided against banning Russian metal as a significant portion of the market was still planning to buy it.

“The decision to maintain Rusal’s aluminium on the exchange, above all, is in the best interests of our global customer base. We have picked up additional contractual sales for 2023 after the LME’s decision, exceeding our initial forecasts,” Rusal said in an emailed comment.

Rusal’s sales had already exceeded 76% of its primary aluminium and value added production for 2023, the company said, confirming an earlier source-based report by Reuters.

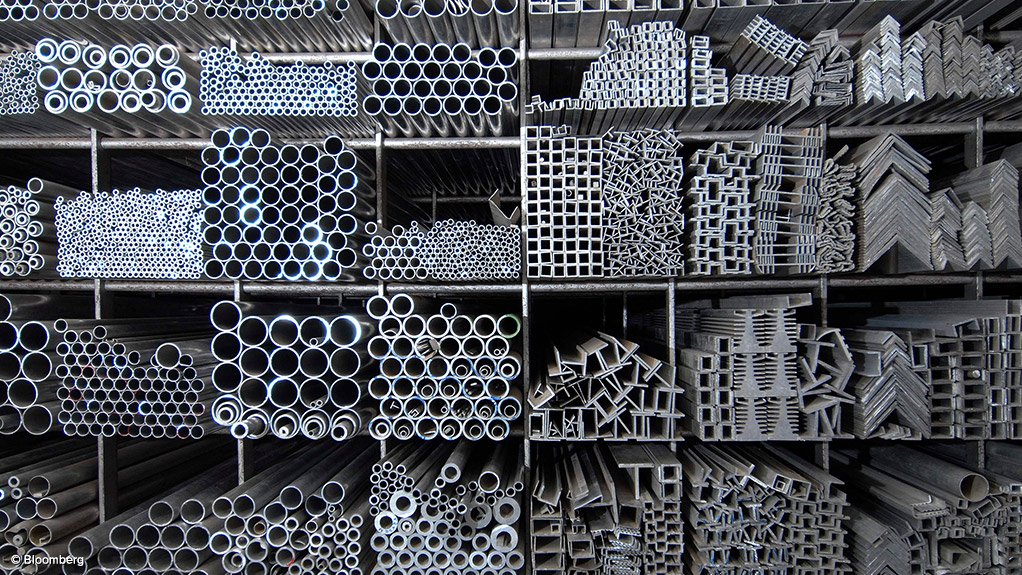

Russia is a major producer of aluminium, while Rusal itself is the world’s largest producer of the metal outside China. Neither Rusal nor Russian-produced aluminium have been directly targeted by sanctions imposed on Moscow since it sent its troops into Ukraine in February.

US-based aluminium producer Alcoa and several other producers have publicly called for Russian metal to be excluded from the LME. However, sources familiar with the matter told Reuters in October that commodity trader Glencore will buy aluminium from Rusal next year.

“Demand for low carbon aluminium is driven largely by the automotive sector and we are seeing renewed interest from across the globe,” Rusal added in its comment.