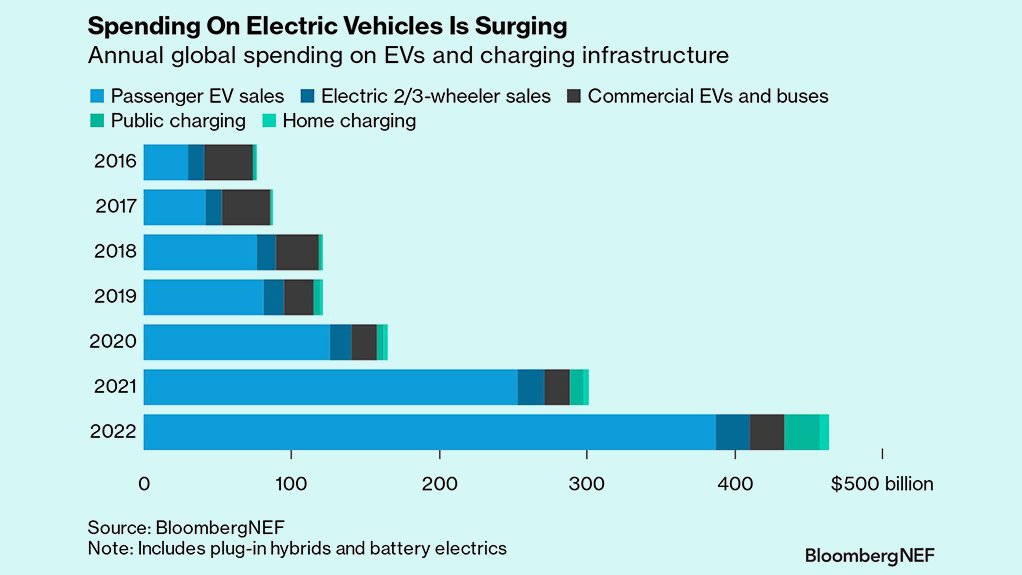

Global spending on electric vehicles (EVs) is surging. According a new report published by BloombergNEF on investment in the energy transition, annual spending on passenger EVs hit $388-billion in 2022, up 53% from the year before.

With the 2022 tally included, the total value of electric vehicles sold to date in the passenger vehicle segment has now crossed $1-trillion. There are a few ways to look at that figure. At the most basic level, if an automaker didn’t have a decent EV strategy, they missed out on their share of a trillion-dollar revenue opportunity over the last decade.

That sounds like a big number, but global auto sales are worth around $2.5-trillion a year. So, over the last ten years since EVs first showed up in the modern era, the value of total car sales has been roughly $25-trillion. In that context, the cumulative value of EV sales is relatively modest. Total profits from EVs also are much lower.

Still, growth rates matter, and almost 60% of total EV spending occurred in just the last 18 months. This year will break records again, with passenger EV sales likely to comfortably exceed $500-billion. This is now a very material, very fast-moving part of global auto sales.

The auto industry operates on long product cycles. While it feels like there’s a constant stream of new products, many are just cosmetic updates to existing models — facelifts, in industry parlance. To understand product cycles and what happens next, it’s important to look at vehicle platforms.

High-volume automakers develop new platforms that underpin vehicles over what is usually a six- to 10-year period. The platforms take years to develop, cost billions of dollars and ideally are versatile, allowing automakers to use different body structures catering to a wider variety of consumer preferences. These platforms also allow for component sharing across many models, which is a necessary part of the cutthroat economics of building vehicles at scale around the world.

Long development cycles also mean that if an automaker has been caught wrongfooted, it can take quite a while to realize the full impact of mistakes. The trillion-dollar EV sales mark is probably the point where it becomes clear that some automakers made the wrong bets.

Japanese automakers illustrate this well. All of the Japanese brands combined sold less than 5% of the EVs purchased globally last year, and none were among the top ten EV brands by volume. This wasn’t a problem in 2019, when plug-in vehicles were just 2.6% of global auto sales, but it’s worrisome when they’ll likely be closer to 18% of sales in 2023.

It’s even more extreme in China, where EVs will likely be over 30% of sales this year, up from just 5% in 2019. That’s a huge change in a timeframe well within the normal life cycle of a vehicle platform. Japanese automakers’ market share in China is now starting to slip, to 21% of new-vehicle sales last year from 25% in 2020.

Alarm bells are ringing at the Japanese automakers now, with Honda revamping its EV strategy and Toyota installing new management preaching an EV-first strategy.

Changing course will take a while. Toyota has said it won’t have a new dedicated EV platform ready for launch until 2027. While that might get accelerated, it reflects the timescales traditional automakers operate on.

Toyota may well still succeed. The company has shown impressive adaptability over its 85-year history, but the point here is that the next vehicle cycle is absolutely critical to turning the ship around. If it misses the mark, the consequences will be dire.

Many other automakers face a similar situation, with their platforms for models due to arrive from 2026 to 2028 largely set. It will take a few years to find out if they’ve made the right bets.

There are still many challenges ahead as EV sales take off. Even after the phenomenal growth of late, only about 3% of the 1.3-billion passenger cars on the road globally will be electric at the end of this year. Soaring demand is also placing real strains on the battery supply chain and public charging infrastructure.

Still, the first trillion dollars highlighted in BNEF’s report marks the beginning of real materiality in the auto sector. EVs have captured mind share and excitement from industry watchers for years. They’re now capturing real market share, too.