After a three-month battle, US gold giant Newmont finally lands its Australian target with a $26.2 billion offer.

The two gold companies have reached an agreement for Newmont to acquire 100 per cent of the issued shares in Newcrest by way of a scheme of arrangement.

Newcrest shareholders will receive 0.400 Newmont shares for each Newcrest share held, representing a value of $29.27 per Newcrest share, or an equity value of $26.2 billion. The company was trading at $28.25 on the ASX at Friday close.

The Newcrest board also unanimously recommended that shareholders vote in favour of the Newmont takeover, at a meeting set to take place in September or October this year.

When the ink dries, Newcrest shareholders will hold a 30.1 per cent stake in the new combined entity. This takeover also raises foreign ownership of Australian gold assets above the 50 per cent margin.

“This transaction will combine two of the world’s leading gold producers, bringing forward significant value to Newcrest shareholders through the recognition of our outstanding growth pipeline,” Newcrest chairman, Peter Tomsett, said.

“The combined group will set a new benchmark in gold production while benefitting from a material and growing exposure to copper and a market leading position in safety and sustainability,” he said.

As part of the arrangement, Newcrest have permission to pay a franked special pre-completion dividend to shareholders of US$1.10 per share.

Newmont chief executive officer Tom Palmer reacted to the arrangement.

“It (the takeover) creates an industry-leading portfolio with a multi-decade gold and copper production profile in the world’s most favourable mining jurisdictions,” he said.

“Leveraging our experience from the acquisition of Goldcorp four years ago, we are positioned to deliver an estimated $500 million in annual synergies and an estimated $2 billion in incremental cash flow from portfolio optimisation opportunities.

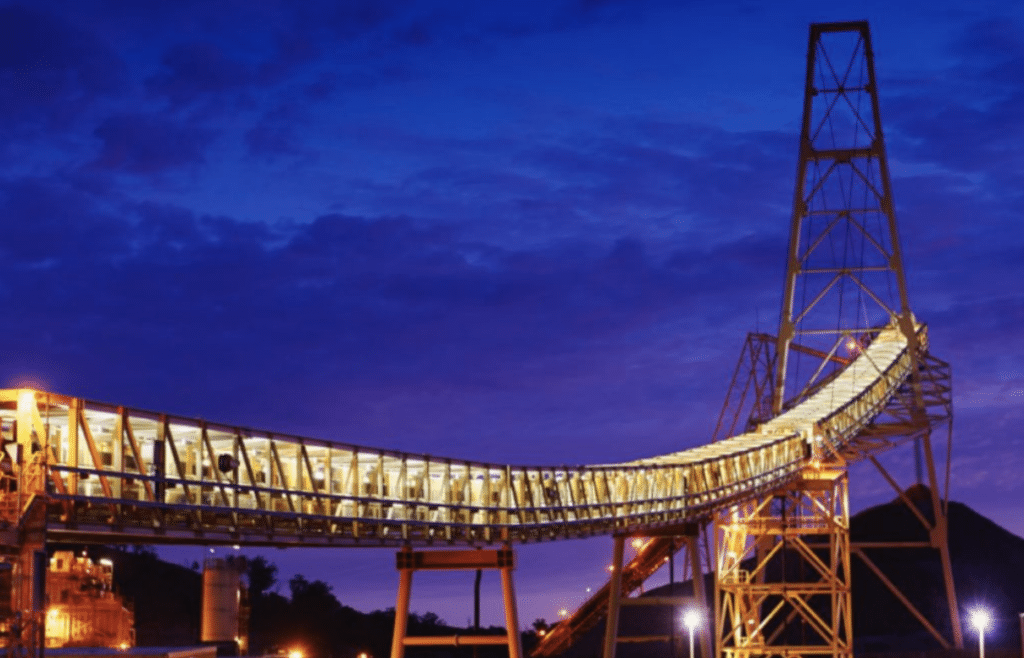

Newcrest – originally a Newmont subsidiary spun off in the 1960s – operates mines in Australia, Canada and Papua New Guinea, with the latter including the notable Lihir mine, one of the largest gold mines in the world.

Newmont first attempted a takeover in February this year with a $24 billion offer, which the Newcrest board rejected.

Not long after, Newcrest granted Newmont exclusive due diligence which paved the way for the current offer.