“As a larger, more diversified and vertically integrated company, we are better positioned to meet the needs of our customers and have even greater flexibility to take advantage of opportunities available throughout market cycles.”

The Mount Cattlin mine in Ravensthorpe, Western Australia brought in $46 million in spodumene revenue during the December 2023 quarter, leading to the mine delivering $571 million in total revenue for 2023.

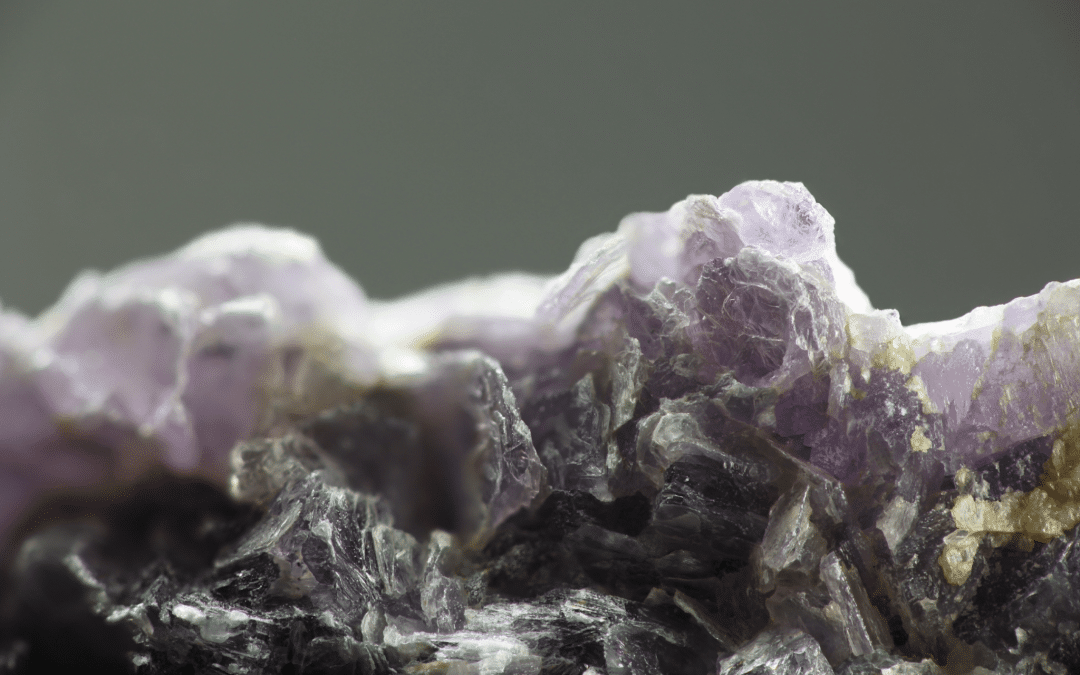

Mount Cattlin produced 69,789 metric tonnes of spodumene concentrate during the quarter at 5.4 per cent lithium oxide grade, bringing the operation’s 2023 production total to 239,312 metric tonnes.

Over 60,000 metric tonnes of spodumene concentrate were sold at an SC6 equivalent price of $US850 per dry metric tonne.

“Strong recovery of 72 per cent demonstrates favourable grade and mineralisation as mining continues in the main part of the orebody,” Arcadium Lithium said.

“Realised pricing during the quarter was impacted by a shift to forward looking reference price mechanisms and the timing of shipments all occurring in the second half of the quarter.”

Considering the lithium downturn, Arcadium Lithium will lower near-term capital spending commitments as it evaluates ways to streamline its project pipeline to deliver additional volumes within customer timeframes.

“It is clear that very few lithium expansion projects make economic sense at current market prices, and the longer prices stay near these levels the greater the impact will be on future supply shortfalls,” Graves said.

Arcadium Lithium expects to spend $450–$625 million in growth capital spending in 2024, with an additional $100–$125 million on maintenance capital spending in store.